Was the Baby Boom a Good Thing for the United Staets

A infant blast is generally considered to be a sustained increase and and so decrease in the birth charge per unit. The The states, the United kingdom and other industrialized economies have experienced only 1 such baby nail since 1900 – the one that occurred after World War II.

In improver, many currently developing economies such equally India, Pakistan and Thailand have experienced a baby boom since 1950 as a outcome of a sustained turn down in baby and kid bloodshed rates every bit a event of improved medicine and sanitation.

Then what'due south the economic touch on of these baby booms? Practise demographics play a role in determining when an economy expands and contracts? Do they heave incomes or cause them to fall as more young people enter the workforce? I've been studying the impact of baby booms on wages, unemployment, patterns of retirement and gross domestic production (Gross domestic product) growth for 20 years and, while there are some questions that haven't been answered, here's what we've learned so far.

Negative bear upon on employment

The initial touch on of a infant boom is decidedly negative for personal incomes.

Infant booms inevitably lead to changes in the relative size of various age cohorts – that is, a ascension in the ratio of younger to older adults – a phenomenon first described by economist Richard Easterlin. (In statistics, a cohort is a group of subjects who have shared a detail result together during a particular time span.)

These furnishings cause a decline in young males' income relative to workers in their prime, a college unemployment charge per unit, a lower labor force participation rate and a lower college wage premium among these younger workers.

This occurs because younger workers are generally poor substitutes for older ones, so the increased supply of youths leads to these negative employment results.

Back in the 1950s, entry-level young males in the The states were able to achieve incomes equal to their fathers' current income. This was because of that age group'due south reduced relative size every bit a upshot of the low birth rates in the 1930s. But by 1985 – about the fourth dimension the peak of the baby smash had entered the labor strength – that relative income had fallen to 0.3; in other words, entry-level men were earning less than one-3rd of what their fathers made.

In developing countries, these relative cohort size furnishings – the reduction in young males' relative income and increment in their unemployment charge per unit – are multiplied by the impact of increasing modern development, especially the ascent level of women'south education.

In addition, the large influx of babe boomers into the labor market in the US forced many older workers, who would otherwise exist working in "bridge jobs" prior to retirement, into earlier retirement. This explains how the average age of retirement for men and women went down in the 1980s.

This decline in income relative to their parents and their ain cloth aspirations has a host of repercussions on family life. It leads to reduced or delayed spousal relationship, lower fertility rates and increased female labor force participation rates as young people struggle to respond to their worsened prospects.

From boom to bust … to smash?

The reduction in relative income – which the US experienced in the '60s and '70s – thus results in a subsequent "baby bust" as people delay starting a family.

Information technology was hypothesized that these baby booms might exist self-replicating equally reduced birth rates on the trailing edge of the boom acquired the subsequent accomplice to be smaller in size, thus leading to improve labor forcefulness weather, increased birth rates and an "echo boom" in the next generation.

This theory was based on what led to the infant boom in the outset place, when the favorable labor market weather experienced in the 1950s emerged as a result of fewer children being born during the 1930s, reducing the young-to-old-adult ratio.

Though the echo boom of the 2000s represented an increase in the absolute number of young adults, it didn't lift their cohort size relative to their parents because nascency rates have remained fairly stable at low rates since the end of the post-WWII babe smash.

That has not, nevertheless, translated into significantly ameliorate labor conditions, at least not the kind experienced by young adults in the 1950s that led to the baby nail. The reasons for this phenomenon accept not withal been explained.

And so tin can changing demographics crusade recessions?

Some other way of exploring the furnishings of changes in the proportion of immature adults in the population is to expect at fluctuations in the relative size of the young developed population over time. These seem to accept a significant effect on the economy.

Every bit young adults move out of high school and college and prepare their own households, they generate new demands for housing, consumer appliances, cars and all the other goods attendant on starting a new adult life. These new households don't account for a large share of full expenditures, but they represent a major share of the growth in total consumer expenditures each twelvemonth.

So what happens if, after a menses of growth in this age grouping, the trend reverses? It is likely that industries counting on further strong growth will exist forced to cutting dorsum on production, and in turn to cut back on deliveries from suppliers – which will in plough cut dorsum on deliveries from their suppliers, creating a snowball outcome throughout the economic system.

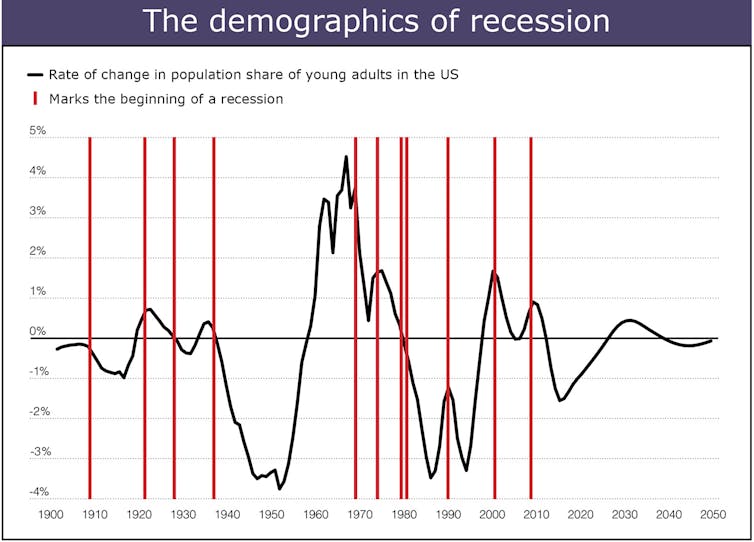

This picture is supported by the patterns over the past 110 years depicted in the graph shown below.

The curve on the graph represents a 3-yr moving average of the annual rate of change in the proportion of young adults in the US population, as given by the United States Census Bureau. "Immature adults" are defined as those anile xv-19 prior to 1950, and twenty-24 in the years subsequently, given changing levels of education over time. This curve is overlaid with vertical lines that mark the start of recessions, as divers by the National Bureau of Economic Research.

There is a very shut correspondence betwixt the vertical lines, and peaks in the bend, likewise as points where the bend turns negative. In addition, the deep trough between 1937 and 1958 contained another iv recessions, and there were two in the trough between 1910 and 1920 (not marked on the graph). The simply recessions over the concluding 110 years that don't appear to correspond to features of the curve, are those in 1920, 1926 and 1960.

The pattern of causation – if it is one – cannot run from the economy to demographics, since these are immature people born over 15 years before each economical downturn. In addition, in that location's a ane-year lag in the age groups that has been used to control for possible migration effects of a recession – that is, how many people left the U.s. equally a result of worse labor market conditions.

The fact that no "double dip" recession occurred in 2012, even as the share of immature people fell that yr, might exist the result of the economical stimulus applied after the most recent recession.

Nutrient for future idea

Apparently there are many other factors associated with economic downturns, merely aspects of the empirical regularity demonstrated here can exist seen in many countries over the past 50 years – peculiarly regarding the international fiscal crises of 1980-82, 1992-94, and 1996-98 and 2007-2008.

This is not to say that demographics were the sole cause of the recessions, but rather that they influenced the timing of such events, given a host of other possible factors. For example, did they play a role in determining when the recent housing bubble burst? That question has yet to be answered, only further study may shine some light.

This commodity is office of a series on What'due south next for the babe boomers.

Source: https://theconversation.com/baby-booms-and-busts-how-population-growth-spurts-affect-the-economy-46056